The right account for your savings

3 minute read

The right account for your savings

3 minute read

The right account for your savings

3 minute read

What’s the best account to make your sunny day dreams come true?

We all have our own idea of what makes life special. Spending time with family; jetting off on holiday; or treating ourselves to new, swanky trainers every now and then. But because everyone’s sunny day wishes are different, it means we might need individual plans to make them a reality.

At Coventry Building Society, we have a range of savings accounts, all with unique features and benefits to boost your feel-good fund. So, whether you want to save for the long or short term, to dip in to your money or keep it locked away, we’ve got something to fit your sunny day savings plans.

Limited access

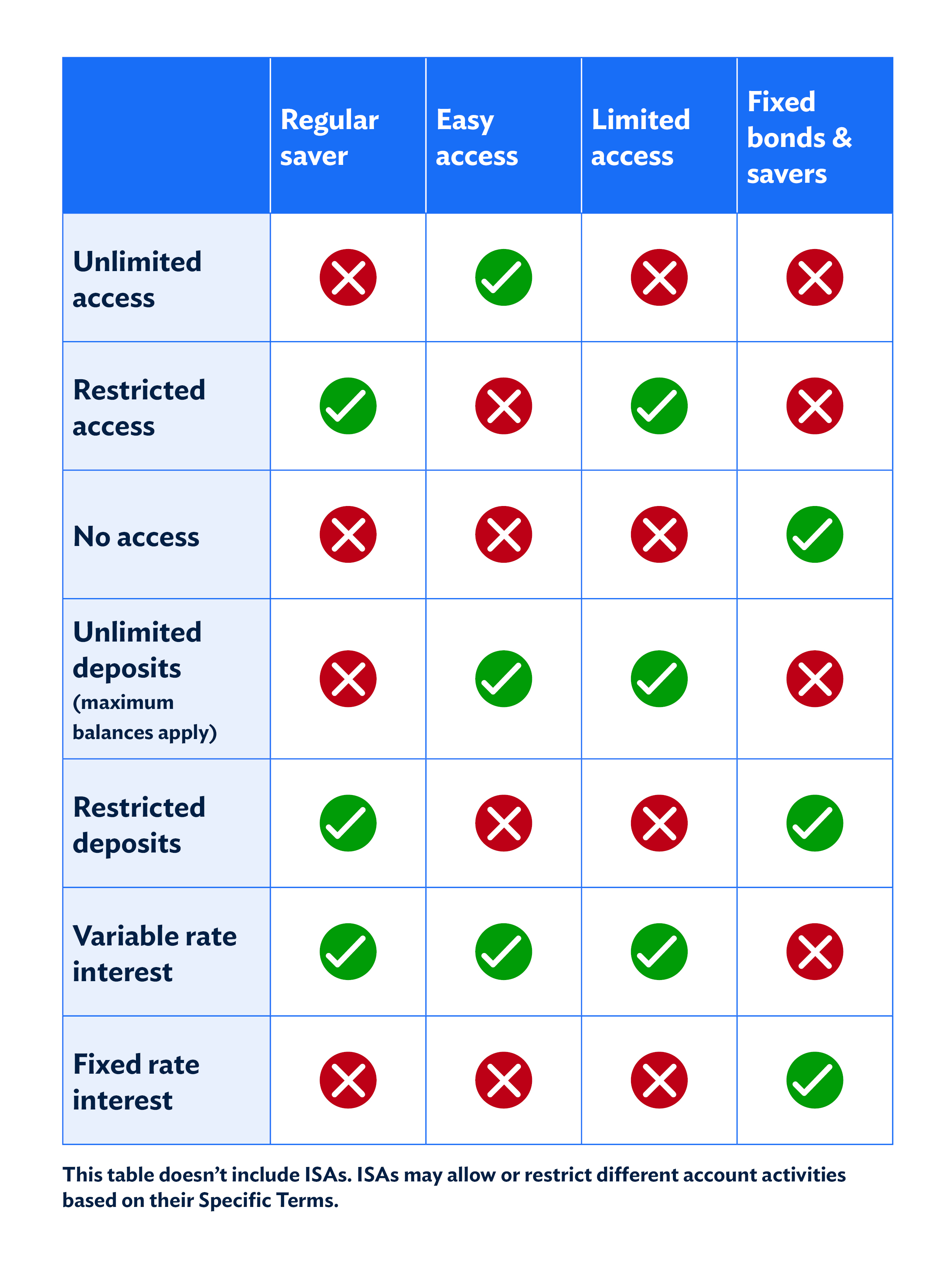

Our limited access accounts are great if you don’t want to lock your money away completely. These accounts usually let you dip into your savings over a 12-month period – depending on the specifics of the account. They’re great if you like to make the most of sunny day plans that crop up across the year. They might include family days to museums or parks, afternoon tea with friends or maybe a group spa day to reset.

Limited access accounts have variable interest rates. They let you pay in up to a specified amount and take money out whenever you want (within your access limit). If you want to take money out more than the account allows, you’ll be charged based on the amount you’re withdrawing.

Easy access

Easy access accounts are perfect if you like full access to your savings. If you love live music, this could be the one for you so you’re always ready when tickets for your favourite band or artist go on sale!

Like your sunny days a bit quieter? Easy access accounts can be there for those unexpected times with family and friends, too. Hosting an impromptu barbeque when the sun shines or a meal out, just to celebrate the fact it’s Friday!

With an easy access account, you can take money out as many times as you like with no charge. With this freedom and flexibility, you’ll usually see easy access accounts have lower interest rates.

Regular savers

Perfect if you’re planning a sunny day in the future!

Regular savers are great for savers, not spenders. You might want to set money aside for next year’s family holiday, or a trip with friends you don’t want to miss. How about a fancy shopping trip, or a weekend on the golf course with nothing to think about but the perfect drive?

With planned regular payments, these variable rate accounts are great for saving a little over time. They often have a limit on how much you can pay in during a certain period. You can usually take your money out at any time, but there may be an interest charge on the amount you withdraw.

Fixed bonds and savers

Got a special sunny day on the horizon? Wedding bells might be ringing, or you might have finally set a date for that dream two-week world cruise you’ve always wanted to do. If that sounds familiar, a fixed rate account could be a great option. These accounts let you put away a bigger amount of money for a set period of time.

Unlike our other accounts, as the name suggests, these accounts have a fixed rate of interest. This means your interest rate won’t change for a set period of time. But with these accounts, you often have no access to your money until the fixed term ends. Because of this, you should be sure your sunny day in the calendar is set in stone.

With fixed accounts, you can only pay money in while the deposit window is open. Extra money can’t be added once it’s closed.

They’re good accounts if you have a lump sum and want the comfort of knowing exactly what you’ll earn in interest. Perfect peace of mind while you count down to your sunny days.

Children’s accounts

Great if you’re under 18 or have children in the family that you’d like to help start saving for their sunny days. These accounts are also a good way to help kids learn positive savings habits.

Every day can seem like a sunny day when you’re younger. But with so many firsts and life-changing moments ahead, finding the right savings account could be difficult. We have some children's accounts with different features – take a look.

What about ISAs?

When you check our website, you might find some of the account types we’ve talked about also have ISA options. ISAs offer a tax-free way to save and make the most of your money.

There’s lots to think about when deciding if an ISA is right for your sunny day savings. You might find it useful to look at our ISAs explained page. This is full of helpful info to help you decide if they’re right for you*

Related articles:

What type of saver are you?

Are you a sunny day saver or a spontaneous spender?