New build properties

New build properties

What is a new build?

Mortgage offers

Saving up for a deposit?

First Home Saver (2)

4.25

(Variable)

AER stands for Annual Equivalent Rate and illustrates what the interest rate would be if interest was paid and added each year.

The gross rate is the interest rate payable before the deduction of tax.

A fixed rate won’t change for the fixed term. A variable rate can go up or down.

The rate shown is based on interest being paid annually.

Frequently asked questions

What do you define as a new build?

We define a ‘new build’, as a property that was built within two years of the date of the mortgage application or is to be occupied for the first time.

What does LTV (Loan to Value) mean?

Loan to Value ratio is how much of your property’s total price is being paid for by your mortgage. A lower LTV often means lower interest mortgage deals compared to higher LTV lending. A higher LTV means you might only have the choice of higher interest rate mortgage products.

How long is my mortgage offer valid for?

We understand things might take a little longer with new build purchases. Our mortgage offers are valid for nine months.

Can I extend my offer?

Yes, you can apply for an additional three-month extension if you need it. You'll also need to re-apply for your mortgage and select a new product after 12 months.

Do you accept builders’ incentives?

We'll accept builders’ incentives up to 10% of the property purchase price, subject to the criteria below.

- Where the value of your builder’s incentive is over 5% and less than or equal to 10%, we’ll deduct this from the purchase price to create a net purchase price. It’s the net purchase price we’ll then use to calculate the LTV.

- If your builder’s incentive is over 10% of the purchase price, we’ll decline the application.

- You must provide a 5% minimum deposit from your own resources – this is excluding any builders’ incentives.

- We’ll calculate the LTV on the purchase price (or net purchase price, where applicable) or the valuation, whichever is the lower.

Do you accept financial incentives?

We'll accept the following financial incentives.

- Builders deposit

- Cashback (single lump sum payments only)

- Stamp Duty contribution

- Above market value part exchange

- Solicitors fees

- Valuation and estate agent fees

Who do you accept builder warranties from?

The warranty must have been issued as a result of periodic checks of the property during the construction or conversion process – a retrospectively applied for and issued building warranty insurance is not acceptable.

- NHBC

- Build Zone including Self-Build Zone (excluding self builds under construction)

- Premier Guarantee

- Building Life Plans T/A TMS Construction

- LABC New Home Warranty

- Castle 10/Checkmate (where outbuildings are included in the construction e.g. a detached garage, an endorsement to include these in the cover is required)

- Build Assure (New Homes Structural Defects Insurance)

- The Q Policy for Residential Properties

- Aedis Warranties T/A HomeProof

- Advantage HCI

- ICW

- Protek New homes warranty

- ARK Residential New Build Latent Defects Insurance

- ABC+

- Global Home Warranties Limited (10 year Structural Defects Insurance Policy)

- One Guarantee

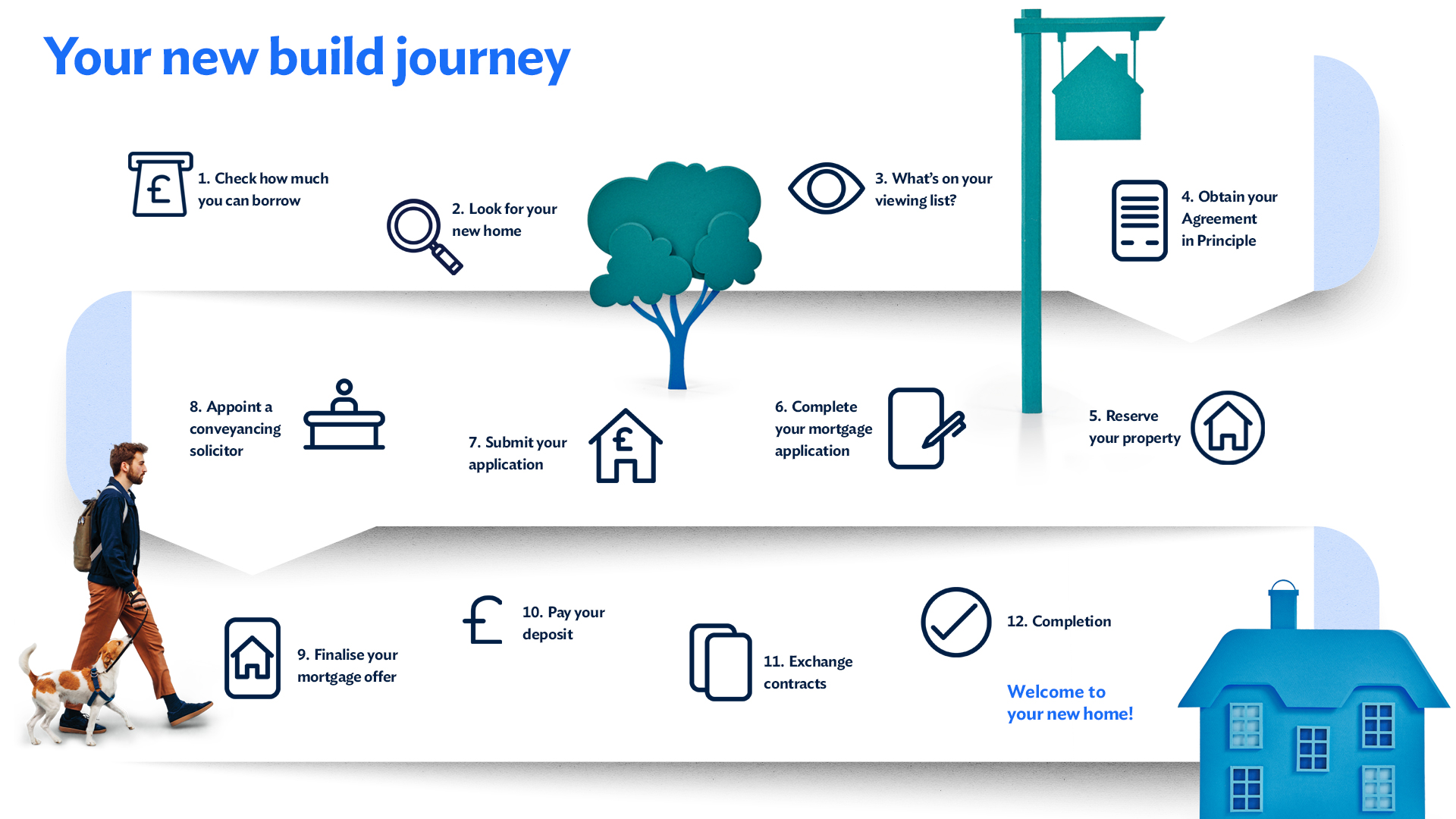

What timescales can you expect?

You normally have 28 days from reservation in which to exchange contracts. Your conveyancing solicitor will check the following:

- the terms of the contract and draft transfer/lease

- the title of the property

- the planning documents

- any other relevant documentation

- whether there’s anything that needs to be clarified by the developer’s solicitor, and any paperwork you need to sign.

Do I need home insurance?

Yes you will, a new build comes with a warranty but that only covers you for the work completed by the developer. You need to be fully covered for other things such as flooding or fire.

Our new build support team

Our specialist new build team is here to help you every step of the way. And we’ll use common sense when we consider your mortgage application.

Call us on 0800 121 8899 to see how we can help you.

Want help?

Our help section is bursting with useful information. If you'd rather chat, just give us a call.

Call us on 0800 121 8899

- Mon-Fri 8am-7pm

- Saturday 9am-2pm

- Sunday & Bank holidays Closed

Yesterday, people waited on average

17 seconds for savings enquiries

17 seconds for mortgage enquiries

Want help?

Our help section is bursting with useful information. If you'd rather chat, just give us a call.

Call us on

0800 121 8899

Saturday

Sunday

9am - 2pm

Closed

Closed

On Saturday, people waited on average

28 seconds for savings enquiries

11 seconds for mortgage enquiries