The base rate drop and the changing economic climate

May 2025

5 minute read

The base rate drop and the changing economic climate

May 2025

5 minute read

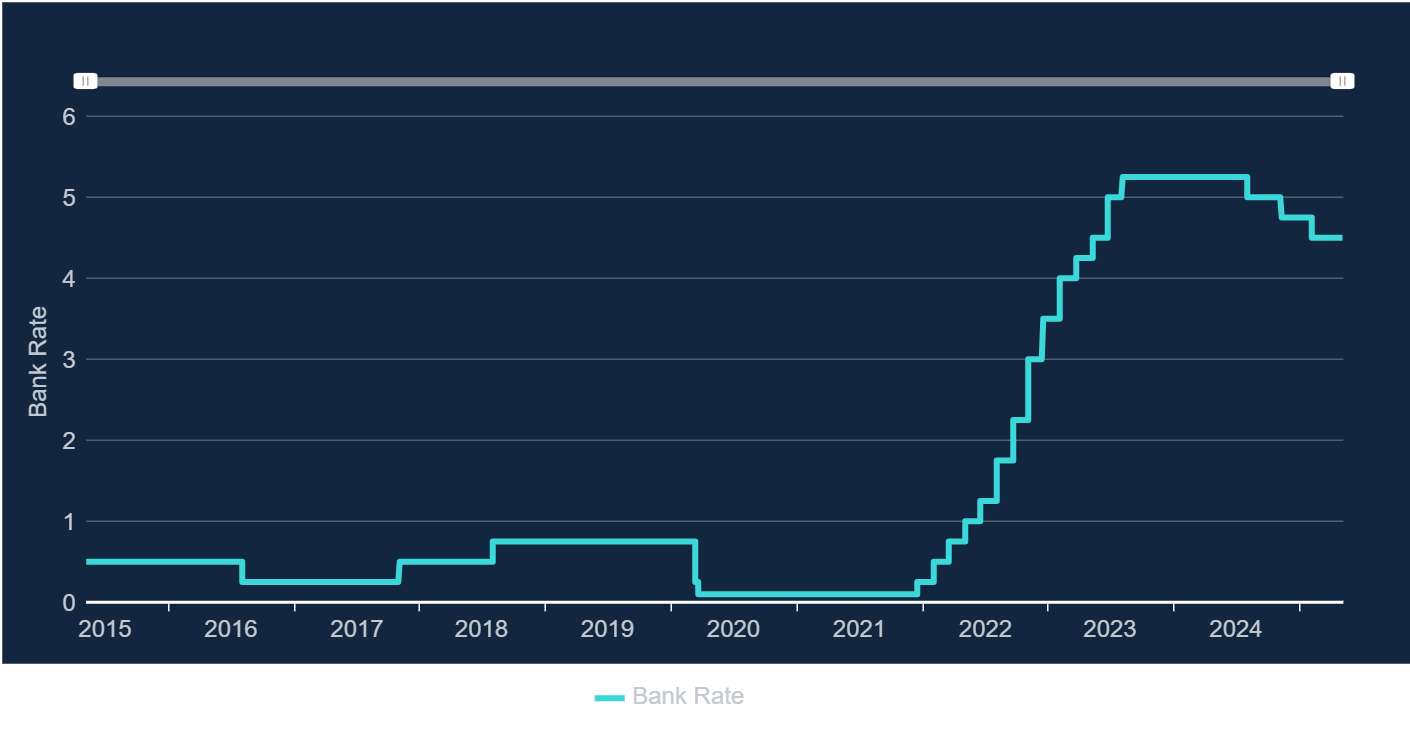

Earlier this month, what a lot of finance experts had predicted would happen, happened... The Bank of England made the decision to cut the base rate once again, moving it from 4.50% to 4.25%.

Interest rates rising and falling can often have a huge impact on your finances. If the base rate is higher, you may be able to find savings accounts that pay more in interest on your savings. But when it’s lower, repaying loans can become less expensive. Although The Bank of England base rate does not directly link to the interest rates we pay on our savings accounts, it can influence a rise or fall on an accounts interest rate.

A brief history of the base rate

In the world of economics, the base rate – the interest rate set by central banks – is a powerful tool, shaping everything from consumer spending to inflation. But its history is far from straightforward, changing over centuries to meet shifting economic needs. Founded in 1694 the Bank of England (BoE) was tasked with financing the government’s war debts. Firstly, it set an interest rate (which was initially known as the 'bank rate') to lend to other banks, balancing the nation’s financial demands with market conditions. Early rates were around 6%, but this was just the beginning of a much more complex relationship between interest rates and the economy.

In the 18th and 19th centuries, the base rate played a key role in ensuring the British pound remained tied to the gold standard, this meant the UK’s currency was fixed to a specific weight of available gold. However, in 1931 Britain departed from the gold standard, allowing monetary policy to focus on Britain’s economic health. Following World War II, the base rate became a formal tool in managing national economic goals, such as controlling inflation and stabilising demand.

The 1970s and 1980s brought a new challenge with soaring inflation. In response, the Bank of England raised rates rapidly, with the base rate peaking at a staggering 17% in 1979. This high base rate was part of a tough monetary policy designed to stop inflation, but this also led the UK into a recession. As time passed, the base rate gradually came down, and by the start of 1998 it had reduced down to 7.50%. The BoE’s newfound independence in 1998 marked a major shift, allowing it to set rates free from political pressure, while inflation remained under control.

The 2008 global financial crisis created an era of ultra-low rates, with the BoE reducing rates to just 0.5% by March 2009 in a desperate bid to stimulate economic growth. Rates stayed low for over a decade, and in 2016, the vote for Brexit saw them dip even further to 0.25%. In 2020, during the COVID-19 pandemic, the BoE dropped rates to a historic low of 0.1% to cushion the economic blow.

However, as inflation started to increase in 2022, by August 2023 the BoE increase rates to 5.25% attempting to combat rising prices. With inflation easing and the economy showing signs of slowing in 2024, the BoE began to reduce the base rate. This downward shift has continued, with markets and analysts closely watching to see if it signals a longer-term return to lower rates, or if future economic challenges will prompt a shift in strategy once again.

Why is the base rate falling?

…And what does it mean for you if you’re a saver or a borrower?

A little more info for savers…

If the Bank of England continues to reduce the base rate, it’s likely that the interest rates on most savings accounts will continue to fall. This would mean, if you were to put your money into a savings account, it would earn less interest than before the rate reduction.

However, if you already have savings tucked away, the impact might not be immediate. If you have a fixed rate savings account, the amount of interest you earn is less likely to change until the fixed rate period ends. Although the base rate is not directly linked to the interest rates paid on variable rate accounts, the impact of interest rate changes can be more immediate.

A little more info for borrowers…

Reductions to the base rate will primarily affect mortgage holders with tracker mortgages, as it can often lead to lower interest payments. And if you're on a standard variable rate (SVR), you might see the rate on your borrowing go down. However, this is at the discretion of your lender.

Much the same as fixed rate savings accounts, if you’re on a fixed rate mortgage, you won’t see your rate come down until the fixed rate period ends. But the reduction to the base rate could mean there could be more competitive mortgage rates available for remortgaging and new home purchases.

Will there be more cuts this year?

Future base rate decisions are likely to hinge not just on the rate of inflation, but also on the health of the overall economy.

Economists polled by Reuters2 are expecting cuts every three months throughout 2025. This would take rates down to 3.75% by the end of the year. The next base rate announcements are on:

- 19 June

- 7 August

- 18 September

- 6 November

- 18 December

Navigating interest rate changes

If it looks like interest rates will continue to fall, you may decide to look for a longer-term savings account that offers a fixed rate of return. This could mean you secure a rate for a few years while rates on variable accounts and new fixed products could drop. But making the right decision really depends on your goals and your circumstances. Are you saving for sunny day in the future or something more immediate? Do you want to have access to your money, or would you be happy to put it into a fixed rate account with additional restrictions? The answers to this question should guide you to an account that’s right for you.

At Coventry Building Society, we offer a range of fixed and variable rate savings products which could help you to reach your goals.

Related articles:

Setting up a Power of Attorney

Read how to set up a power of attorney with us.