Offset mortgages – Could they be a better option for you?

Last updated February 2026

3 minute read

Offset mortgages – Could they be a better option for you?

June 2025

3 minute read

What is an Offset mortgage?

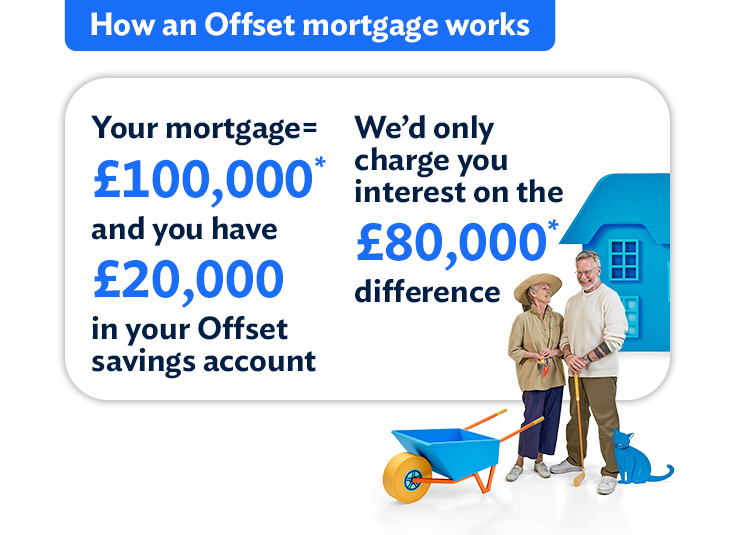

An Offset mortgage links your mortgage to a savings account so you can ‘offset’ your mortgage balance with your savings. Your savings balance reduces the amount of mortgage interest you’re charged.

With an Offset mortgage, you still need to make your contractual mortgage payment each month, but we only charge interest on the difference between your Offset savings balance and the mortgage amount. This is called your Offset benefit.

Here’s an example of Offset in action:

The Offset savings account

An Offset savings account is an easy access account which is linked to your mortgage. The money in your account won’t earn interest because it’s offsetting the interest payable on your mortgage.

You should consider that you won’t make the most of your Offset benefit if your savings balance is greater than your outstanding Offset mortgage balance or you have a zero balance in your Offset savings account.

We recommend you regularly review your account balances and consider moving any surplus money to another account that pays interest on your savings.

Repayment options with your Coventry Building Society Offset mortgages

With a repayment Offset, you have two options as to how you can use your Offset benefit. You can either reduce the mortgage term or your monthly mortgage payment, whichever suits you best.

Option 1 – Reduce the overall term of your mortgage

The Offset benefit reduces the outstanding balance which shortens the time it takes to pay off your mortgage. If you choose this option, your monthly mortgage payments may change, for example, because of a rate change or a capital repayment.

* This example assumes a fixed interest rate across the entirety of the mortgage for illustration purposes only. The example also assumes no change to the savings balance for the full mortgage term.

When applying for an Offset mortgage a full illustration will be provided to you to confirm the associated costs and reversionary rates* of the recommended product for your circumstances. A reversion rate is the interest rate your mortgage moves onto after the end of its initial term (e.g. a five year fixed rate mortgage will revert to our Standard Variable Rate (SVR) at the end of the five years - SVR is the reversionary rate).

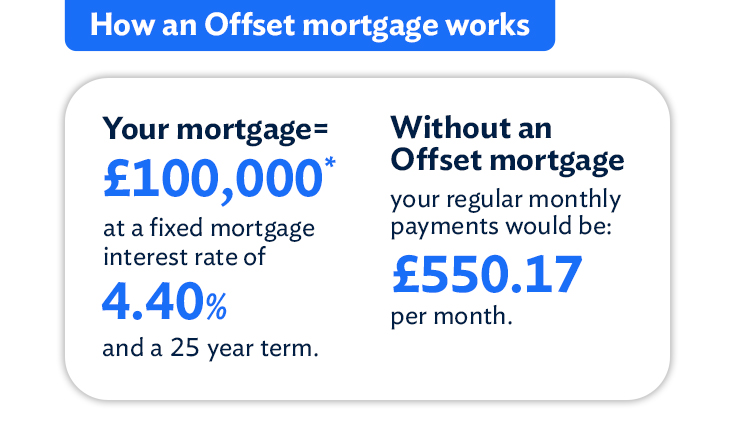

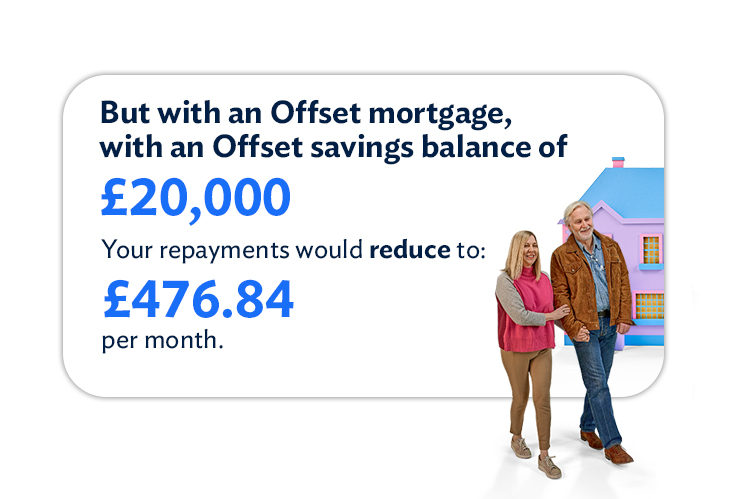

Option 2 – Reduce your monthly mortgage payment

At the end of each month, the Offset benefit automatically reduces the amount you pay by Direct Debit (you must pay by Direct Debit) by the same amount for the next monthly mortgage payment.

You’ll still pay your mortgage for the full term, but depending on how much money you have in your Offset savings account, you pay less mortgage interest each month.

* This example assumes a fixed interest rate across the entirety of the mortgage for illustration purposes only. The example also assumes no change to the savings balance for the full mortgage term.

When applying for an Offset mortgage a full illustration will be provided to you to confirm the associated costs and reversionary rates* of the recommended product for your circumstances. A reversion rate is the interest rate your mortgage moves onto after the end of its initial term (e.g. a five year fixed rate mortgage will revert to our Standard Variable Rate (SVR) at the end of the five years - SVR is the reversionary rate).

Interest-only Offset mortgages

You may have heard of an Interest-only Offset mortgage where payments only cover the interest charged and none of the actual amount borrowed. There are some specific criteria you’ll need to meet before you can apply for an Interest-only mortgage with us.

You can request a copy of our Interest-only mortgage leaflet by calling us on 0800 121 8899.

Could an Offset mortgage be right for you?

Here are some things to consider:

• Offset mortgages are often best suited for those who keep a savings balance they don’t need to access daily. If you have no savings to significantly impact your repayments, it may not provide enough Offset benefits.

• They can be a flexible mortgage repayment strategy as you’re not fixed into a pre-agreed term.

• They can be a good option if you want to reduce your mortgage term or monthly payments without spending savings on an overpayment.

• At Coventry Building Society, we don't currently offer Offset mortgages for Buy to Let (BTL), meaning landlords may not be able to benefit from an Offset account.

• Interest rates on Offset mortgages can be slightly higher than standard mortgages, but the interest savings over time could outweigh this cost.

• No tax is paid on the savings benefit because interest is reduced rather than earned, making this beneficial for higher-rate taxpayers who have a smaller or fully subscribed personal savings allowance/ISA allowance.

In summary Offset mortgages can offer a flexible, tax-efficient way to reduce the cost of borrowing and make your savings work harder. If an Offset mortgage aligns with your goals, it may be worth exploring further when reviewing your mortgage and savings strategy and could help you maximise your personal financial benefits.

Want to know more and find out if an Offset mortgage could be the right option for you look at our Offset mortgages guide for more information. Existing mortgage customers should call us on 0800 121 8899 if they are considering changing to an Offset mortgage.

Related articles:

Fixed vs variable mortgages

Explore how to choose the right deal for you in 2026.