Transfer an ISA into Coventry Building Society

You might have an ISA with us or with another provider that isn't working hard enough for you. To get the best out of your money, find a new ISA that suits your financial goals and transfer your ISA over.

Bear in mind, you'll need to make sure the ISA you're transferring to allows transfers in.

What do you want to know?

Three steps to ISA transfer

How long do ISA transfers take?

Full and partial ISA transfers explained

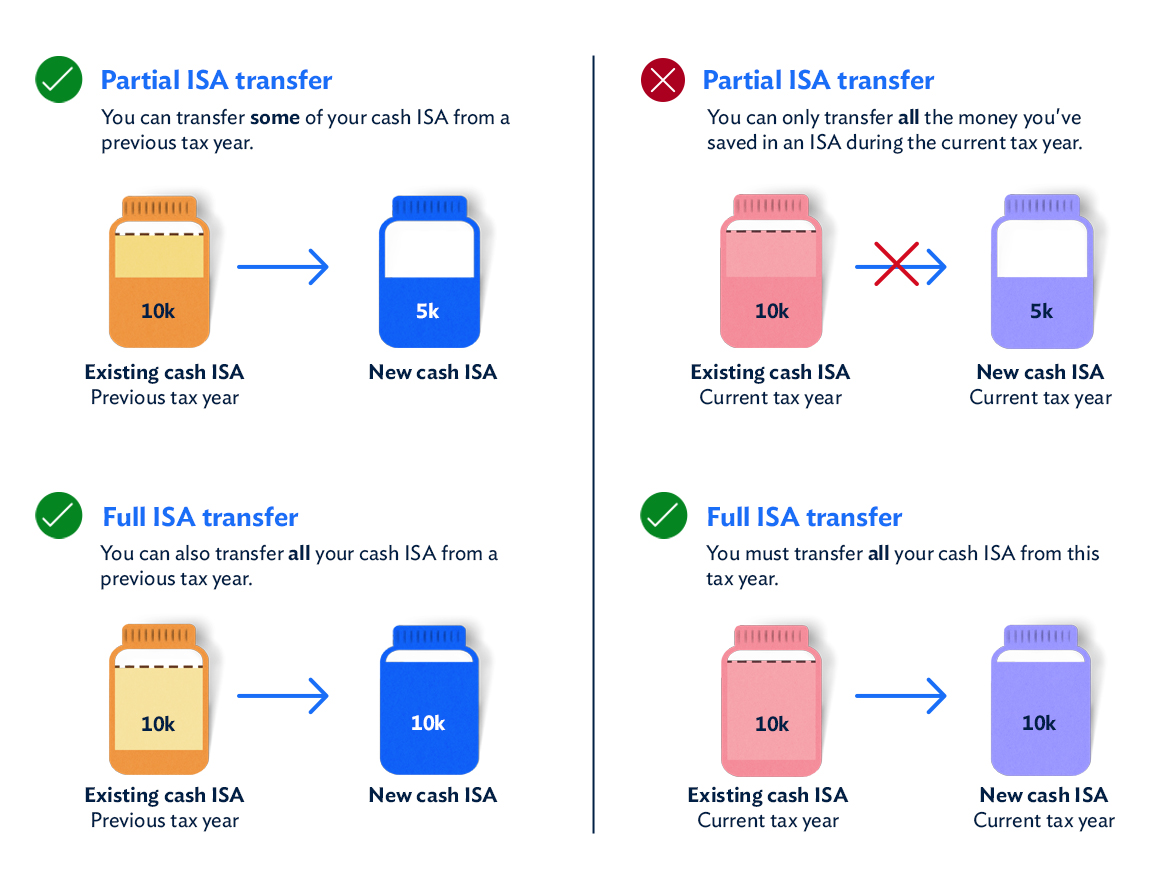

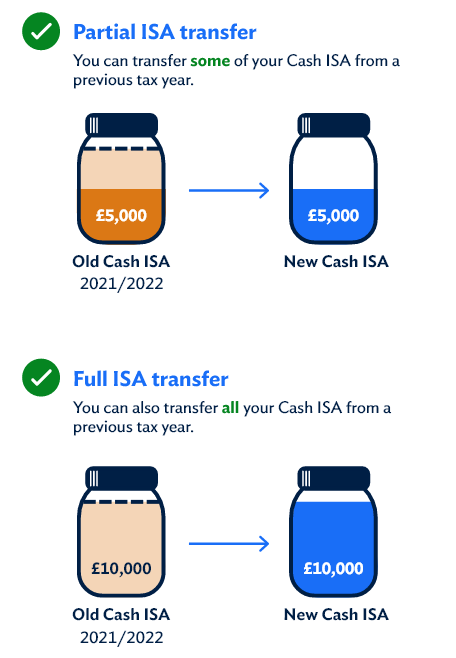

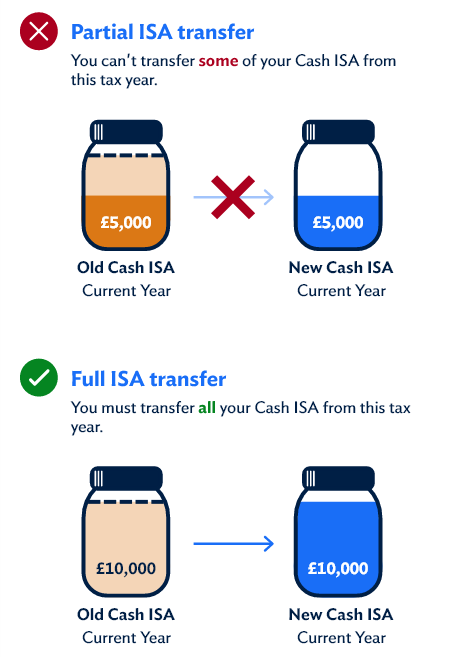

How do full and partial ISA transfers work?

If you have an ISA with us or another provider, you can transfer savings from it into another ISA with Coventry Building Society. You can transfer your savings in full (the full amount is transferred into your new ISA) or partially (only a part of the amount is transferred into your new ISA dependent on whether you are moving your current year's ISA savings or those from a previous year).

Here are some things you need to know:

- If you're transferring ISA savings from your cash ISA for the current tax year, you need to transfer the full amount.

- If you're transferring money you saved in a previous tax year, you can transfer the full amount or part of it. You can also transfer savings from more than one previous ISA.

- If you've created a flexible ISA allowance, you can't transfer the flexible amount when you transfer your ISA savings.

- Please be aware that if you transfer the funds yourself the will lose their tax-free status, even if you are moving them between different ISAs. Please ask us for an ISA transfer.

The easiest way to ask us to move funds between your Coventry Building Society ISAs or from another ISA provider is by using our Online Services. You can also call us or visit us in branch. If you’re looking to do a partial transfer within Coventry Building Society, please call us at 0800 121 8899 or pop into a branch - we’d be happy to help.

Can I transfer my savings from a stocks and shares ISA into Coventry Building Society?

Why has my transfer failed?

We’re sorry your transfer has not gone as smoothly as expected.

Sometimes an ISA transfer fails if the wrong account number has been entered, if there's been a mismatch of customer information, or the incorrect transfer details have been provided. Other potential reasons may be related to your current provider: they may have rejected the transfer due to lack of funds or an error on their side.

If your transfer has failed, please call us or pop into a branch - we’re more than happy to investigate what has happened and resolve the issue.

Want help?

Our help section is bursting with useful information. If you'd rather chat, just give us a call.

Call us on 0800 121 8899

- Mon-Fri 8am-7pm

- Saturday 9am-2pm

- Sunday & Bank holidays Closed

Yesterday, people waited on average

17 seconds for savings enquiries

17 seconds for mortgage enquiries

Want help?

Our help section is bursting with useful information. If you'd rather chat, just give us a call.

Call us on

0800 121 8899

Saturday

Sunday

9am - 2pm

Closed

Closed

Yesterday, people waited on average

28 seconds for savings enquiries

20 seconds for mortgage enquiries